[Editor’s word: Wish to get this free weekly recap of TechCrunch information that startups can use by e-mail? Subscribe here.]

There are just a few on-line productiveness shares booming, and some fashionable remote-first product firms nonetheless asserting funding rounds amid a huge new wave of unicorn layoffs. However what concerning the beforehand white-hot software-as-a-service class general?

Pullbacks in spending are anticipated on the whole, clearly, which suggests larger churn and slower development for main SaaS firms. An off-the-cuff peer survey put collectively by Gainsight CEO Nick Mehta signifies that many main execs within the house anticipate churn to go to double digits within the close to future, Alex Wilhelm realized whereas researching the topic this week for Extra Crunch.However, the consequences of a lot of the world going distant might find yourself nonetheless being an even bigger elevate for a lot of firms giant and small. George Kurtz, CEO of publicly traded cybersecurity firm Crowdstrike, expects international development as mainstream companies all over the place get severe about distant for the primary time.

In the meantime, contemporary index information from Profitwell appears to already present a little bit of a rebound in subscriptions following weeks of drops, which Alex digs into separately. It’s most likely too quickly to be hopeful, however anecdotally Additional Crunch’s personal development has gotten again to its beforehand sturdy footing in the previous couple of weeks (thanks for the assist, everybody).

He additionally caught up with Mary D’Onofrio, an investor with Bessemer Enterprise Companions about the best way to worth a startup throughout a downturn. She additionally identified that most of the losses you’re seeing are relative. “We’re simply reverting again to historic cloud software program multiples. Traditionally when you have a look at the rising cloud index basket, it’s traded at seven instances ahead [revenue]. Proper now we’re buying and selling at eight instances ahead [revenue].” At the least for a lot of firms within the house, issues are nonetheless not so dangerous.

The enterprise capital crunch continues

We’ve been writing a daily-ish collection of articles concerning the state of startup investing within the face of COVID-19. First up, Danny Crichton breaks down “the denominator effect” on TechCrunch, the place a restricted accomplice is required by way of their very own funding agreements to allocate a mixture of equities past startups and rebalance based mostly on the circumstances. When the opposite parts lose an excessive amount of (akin to, say, public shares), LPs then have to tug again on the amount of cash they'll have in enterprise capital companies… thereby leaving these companies wanting cash for startups. The place is that this going? “If the markets occur to quickly recuperate, they could rapidly reopen their investments in VC and different various belongings,” Danny writes. “But when the markets keep bitter for longer, then anticipate additional downward gravitational pull on the VC asset class as portfolio managers reset their portfolios to the place they want them. It’s the tyranny of fifth grade arithmetic and a posh monetary system.”How can enterprise companies navigate this daunting terrain? Connie Loizos checks in for TechCrunch with Aydin Senkut of Felicis Ventures (“now might be one of many hardest instances” to get a agency launched), Charles Hudson of Precursor Ventures (discover some household places of work who're going to be much less orthodox on the whole and doubtlessly much less affected) and Eva Ho of Fika Ventures (don’t get discouraged, however use the extra problem to essentially mirror about this profession alternative).

Try extra protection over on Additional Crunch, together with a quick survey of other investors about their approaches, an interview with a venture debt lender, and a have a look at the trends in funding going again to final yr.

The content material library is king for TikTok

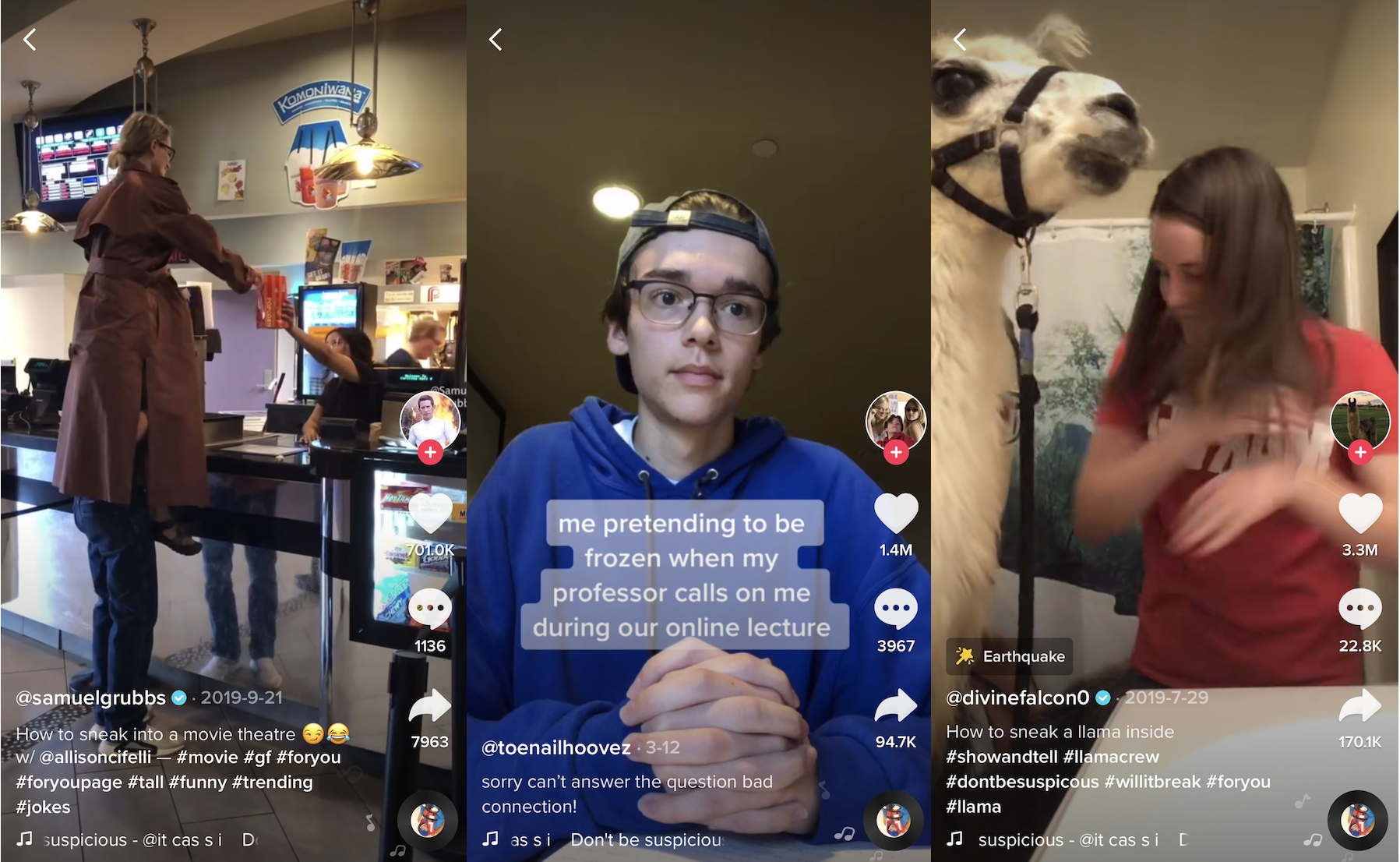

Why is TikTok capable of dominate the charts within the face of big rivals? As hundreds of thousands sit at dwelling utilizing the app, Josh Constine dives into why it's more likely to proceed beating incumbent shopper merchandise from firms like Alphabet and Fb (or shopper startups). It’s what he calls the “content material community impact,” as he detailed on TechCrunch:Facilitating remixes affords a strategy to decrease the bar for producing person generated content material. You’d don’t need to be astoundingly artistic or unique to make one thing entertaining. Every particular person’s life experiences inform their perspective that might allow them to interpret an concept in a brand new manner. What started with somebody ripping audio of two individuals chanting “don’t be Suspicious, don’t be suspicious” whereas sneaking by way of a graveyard in TV present Parks and Recreation led to individuals lip syncing it whereas making an attempt to flee their toddler’s room with out waking them up, leaving the home carrying garments they stole from their sister’s closet, making an attempt to maintain a llama as a pet, and photoshopping themselves to look taller. Except somebody’s already performed the work to report an audio clip, there’s nothing to encourage and allow others to place their spin on it.

Healthtech within the time of COVID-19

Right here’s CRV’s Spohn, summing the state of affairs up properly: “COVID-19 is driving alternatives, notably the fast adoption of telehealth/digital care by clinicians and sufferers, scientific trials within the cloud, in addition to renewed concentrate on fast point-of-care diagnostics. With digital care, we’re seeing a decade of acceleration occurring in a matter of weeks. Up till this level, there was high-activation power to conduct a primary “eVisit” as a result of the choice (in-person care) was so well-established and largely out there.”

Read the full thing on Extra Crunch.

Round TechCrunch

- From Danny: On Monday, prolific enterprise seed investor Jonathan Lehr of Work-Bench can be joining us for a live conference call on TechCrunch. Work-Bench has been an investor in such notable investments as Tamr, Cockroach Labs, Backtrace, Socure, and x.ai. Danny and Alex will quiz Jon on all types of questions round what the seed stage seems like for enterprise startups lately, and naturally, will take questions from Additional Crunch members.

- Disrupt may have a distant model this yr, which we’re now starting to promote as a Digital Pass. Test it out!

Throughout the week

TechCrunchProposed amendments to the Volcker Rule could be a lifeline for venture firms hit by market downturn=

The space in between: The stratosphere

Test and trace with Apple and Google

Want to survive the downturn? Better build a platform

Using AI responsibly to fight the coronavirus pandemic

Additional Crunch

Lending startups are angling for new business from the COVID-19 bailout

What happens to edtech when kids go back to school?

Amid shift to remote work, application performance monitoring is IT’s big moment

Rebecca Minkoff has some advice for e-commerce companies right now

#EquityPod

From Alex:How are you holding up? Are you maintaining? And most significantly, are you hydrating your self? There’s a lot information recently that we’re all falling a bit behind, however, hey, that’s what Fairness is for. So, Natasha, Danny, and Alex received collectively to go over a variety of the largest tales within the worlds of personal firms.

A warning earlier than we get into the listing, nonetheless. We’re going to be protecting layoffs for some time. Don’t learn extra into that past a word to this unlucky state of affairs. We attempt to discuss an important information, not what brings delight or pleasure to our hearts (as a result of if that was the case, we might be throughout mega-rounds). That in thoughts, right here’s this week’s rundown….

Which you can find here!

Source link

Comments

Post a Comment